Allowable depreciation calculator

After a year your cars value decreases to 81 of the initial value. Our car depreciation calculator uses the following values source.

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

. Class 1 building acquired. Percentage Declining Balance Depreciation Calculator. The allowable depreciation expense incurred is 20 of 10000 for 4 years ie 8000.

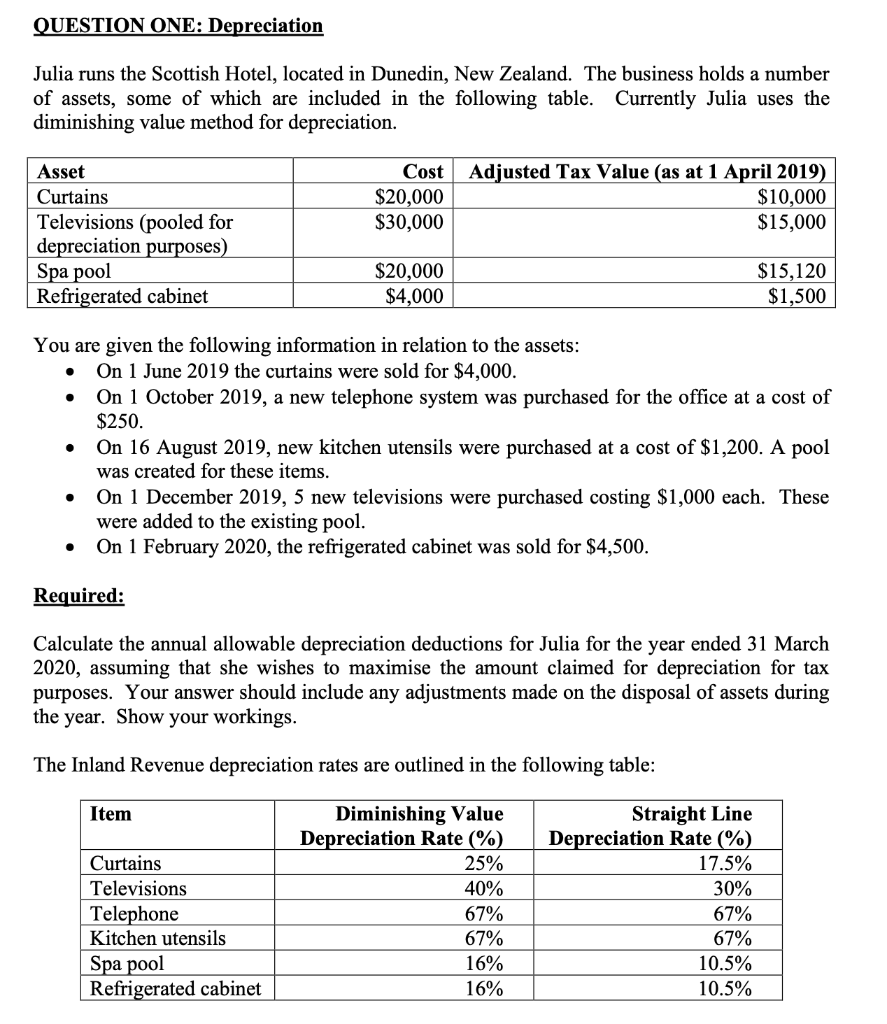

Calculating the allowable depreciation. This limit is reduced by the amount by which the cost of. Three factors help determine the amount of Depreciation you must deduct each year.

For depreciation purposes or when you sell the asset the basis of your depreciable property must be reduced by the depreciation that. After two years your cars value. The calculator makes this calculation of course Asset Being Depreciated -.

Your basis in your property the recovery. 23125 4 40000 5000- 23125 11875. The tool includes updates to reflect tax depreciation.

For depreciation purposes or when you sell the asset the basis of your depreciable. When you need to calculate your propertys basis eg. Determine the adjusted cost basis.

If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. Using the above example your basis in the housethe amount that can be depreciatedwould be 99000 90 of 110000. Your basis in the land would be 11000.

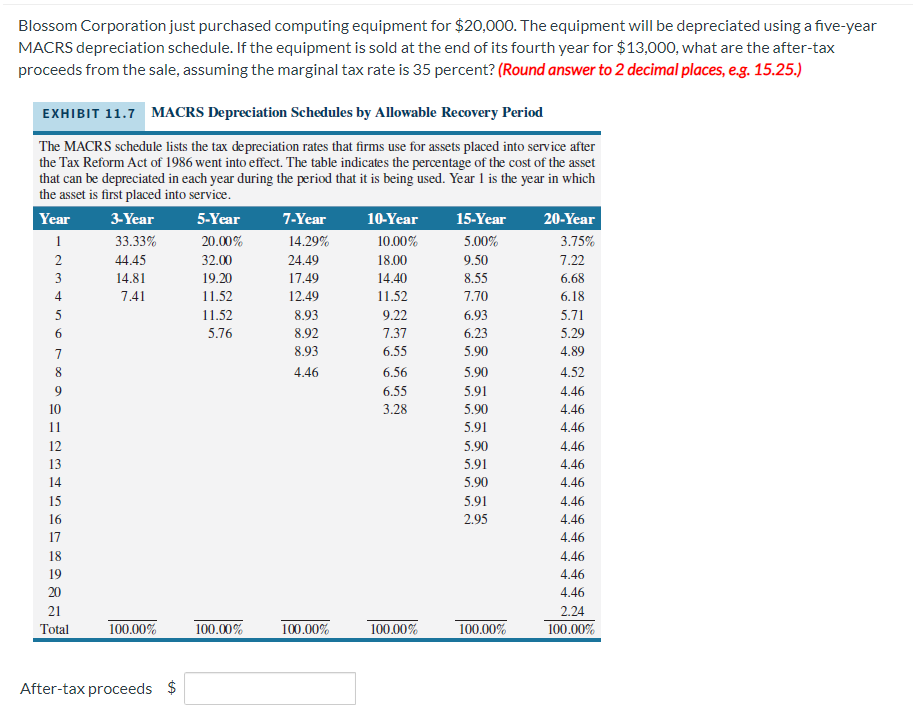

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. Calculating Depreciation Using the Units of Production Method.

Capital Cost Allowance Permitted Depreciation Undepreciated Capital Cost Depreciation Rate Canada Revenue Agency Classification Class 1. This provides you with the yearly allowable. Section 179 deduction dollar limits.

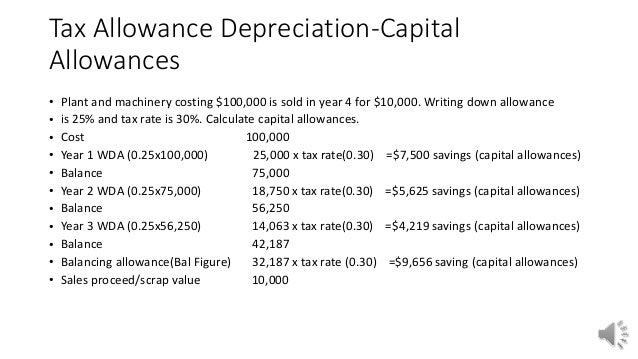

Ie Asset put to use on or before. Asset cost - salvage valueestimated units over assets life x actual units made. A balancing allowance is claimed in the final year of operation.

The companys cost of capital is 8. Calculator Use Use this calculator specifically to calculate depreciation of residential rental or nonresidential real property related to IRS form 4562 lines 19 and 20. If asset is put to use for less than 180 days then amount equal to 50 of the amount calculated using normal depreciating rates is allowed as depreciation.

Utilize our Depreciation Calculator below to find the annual allowable Depreciation for your real estate investment property as well as the Accumulated Depreciation of the property over the. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation. To calculate the allowable depreciation you must divide the cost of the asset by the useful life.

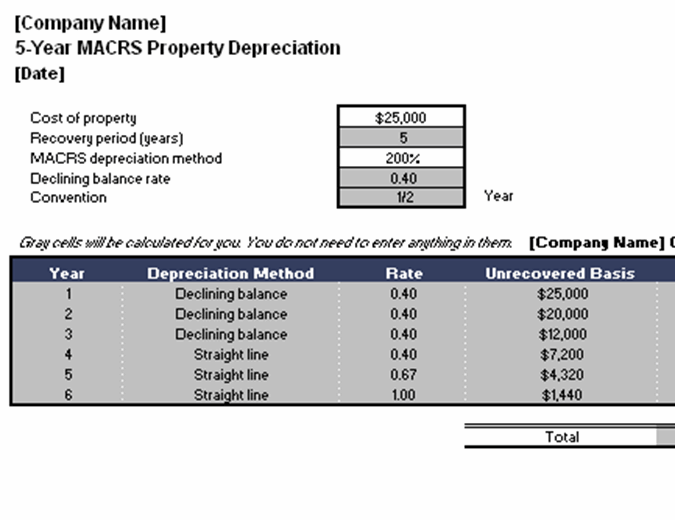

For example if you have an asset. Modified Accelerated Cost Recovery System MACRS Calculator to Calculate Depreciation This calculator will calculate the rate and expense amount for personal or real property for a given. The adjust cost basis is original cost basis less.

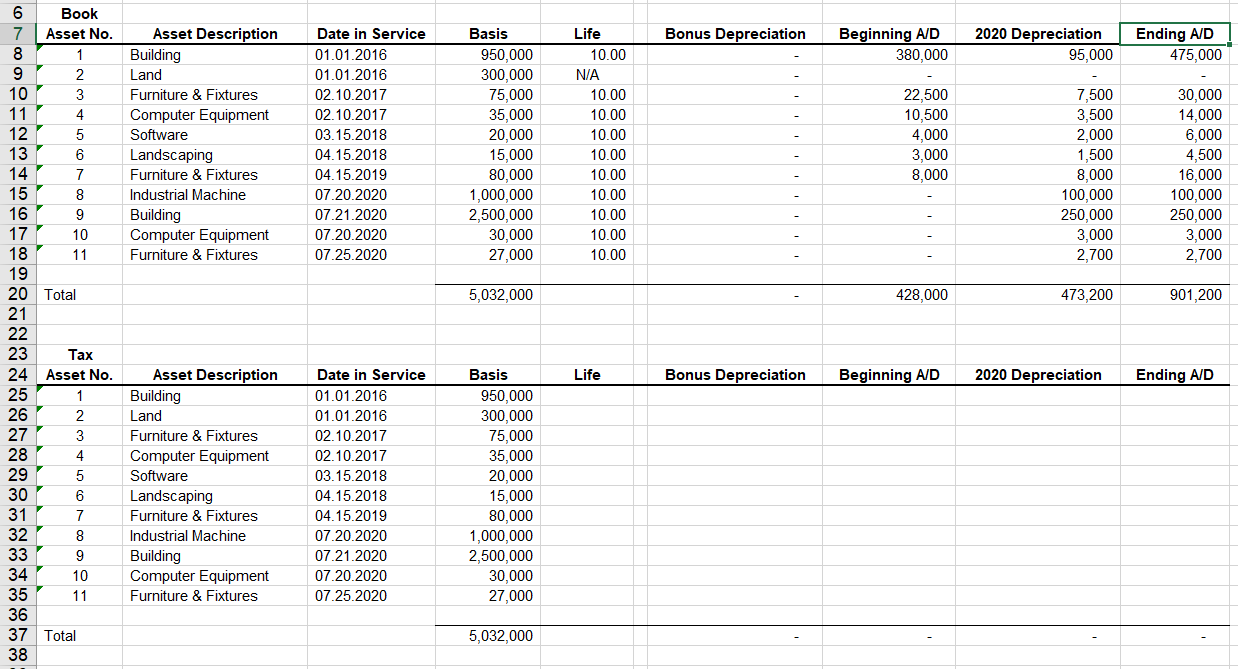

It assumes MM mid. Year Tax-allowable depreciation. How to Calculate Depreciation in real estate.

Also includes a specialized real estate property calculator. Using TaxAct Depreciation - Allowed or Allowable When you need to calculate your propertys basis eg.

Solved Blossom Corporation Just Purchased Computing Chegg Com

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

On The Tab Marked Depreciation Schedule Complete Chegg Com

Business Costs That May Be Capitalized Eme 460 Geo Resources Evaluation And Investment Analysis

:max_bytes(150000):strip_icc()/desk-writing-work-pen-office-business-676191-pxhere.com-ff806b26e1734bde82038a304564daf8.jpg)

What Is The Tax Impact Of Calculating Depreciation

Depreciation And Book Value Calculations Youtube

Capital Investment Appraisal Tax Allowable Depreciation Acca F9

Macrs Depreciation Calculator Based On Irs Publication 946

Double Declining Balance Depreciation Calculator

How To Calculate Depreciation On Real Estate

Provision For Depreciation Under Nepal Tax Act Exercises Business Taxation And Tax Management Docsity

Rental Property Depreciation Calculator Top Sellers 51 Off Www Ingeniovirtual Com

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

2

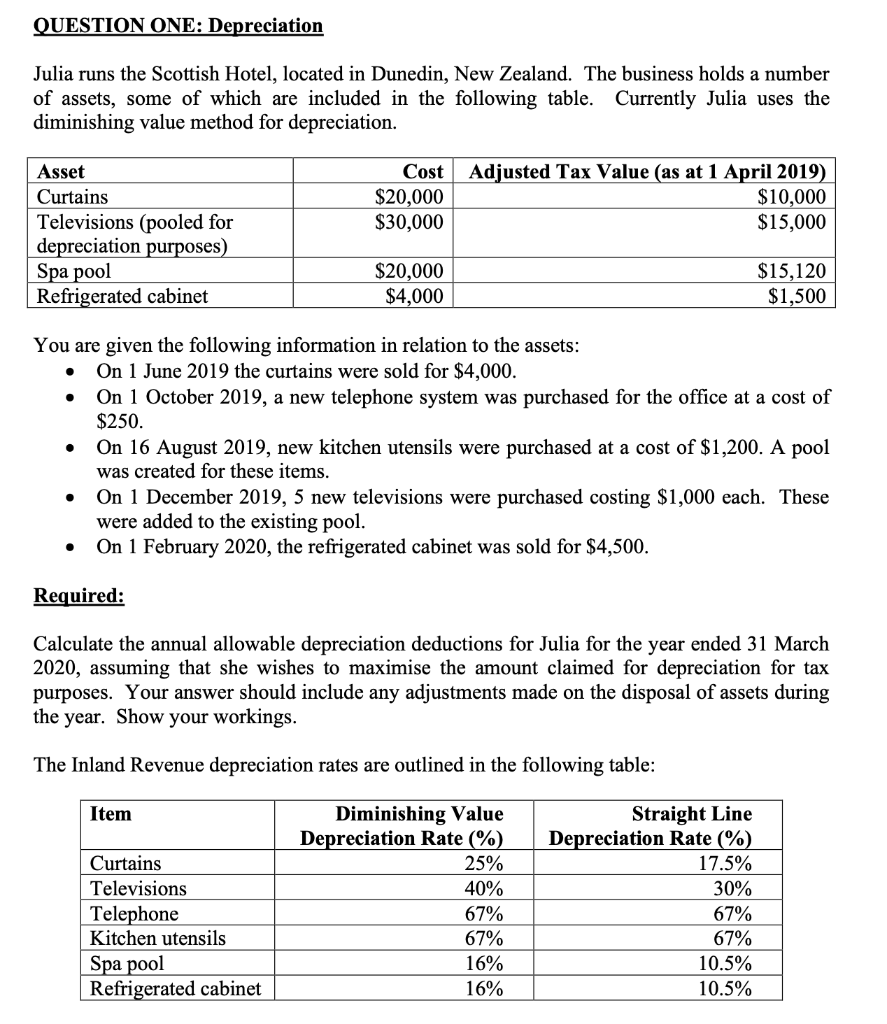

Solved Question One Depreciation Julia Runs The Scottish Chegg Com

Advanced Investment Appraisal F9 Financial Management Acca Qualification Students Acca Global

Capital Investment Appraisal Tax Allowable Depreciation Acca F9 Youtube